Gift Planning

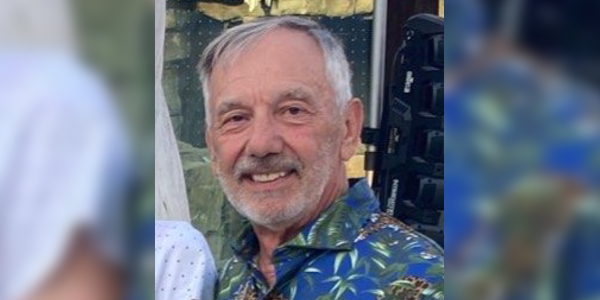

Jim Cole '71 Provides Opportunities while Avoiding Taxes

Jim Cole '71 was a first-generation college student whose time at Geneseo was one of the first stepping stones in his professional career. Geneseo exposed Jim to a whole world beyond his tiny western New York hometown. Now he's making that same opportunity available to a new generation of students - and saving money on his taxes - by making gifts to the Geneseo Foundation through Qualified Charitable Distributions from his IRA.

"I was a first-generation college student," Jim says. "Through the liberal arts classes I took, the professors I had, and the activities in which I became involved, together they made me see the future held unlimited potential for anyone who wanted to strive to achieve something beyond their wildest childhood dreams."

"Additionally, some of the people I met over 50 years ago while at Geneseo have become lifelong friends although we now live miles apart. Twelve of us still have a Zoom call every couple of months. We now live in New York, Pennsylvania, Florida, Texas, California and Saskatchewan, Canada, and I live in Kansas City. So our Geneseo roots have covered the US (and Canada)."

Jim's gifts are designated Where Need is Greatest to offer the college the maximum flexibility to respond to needs and opportunities. "I believe in Geneseo. They have professional educators making the decisions that need to be made to have Geneseo existing into the future. They know where the need is most today. I don't. If I didn't believe they knew the right decisions to make, I wouldn't be making my gift."

By using Qualified Charitable Distributions (QCD) that go directly from his IRA to the Geneseo Foundation, Jim avoids having his Required Minimum Distributions (RMD) increase his taxable income. "QCDs are one of the most tax advantageous ways to make a current gift to any charity," Jim says. "If you need to take an RMD from your IRA, a QCD allows you to offset your 1099-R income dollar for dollar with the amount of the QCD. In other words, you don't need to pay any tax on the RMD if it goes directly to a charity."

"I have been building retirement savings since the 1970s. I consider this RMD as 'found' money now. I don't need all of it to live on, but I still have to pay tax on it as it comes out unless I give some to charity. I don't have to pay tax on the amount I give to charity. The charity gets the RMD 100% tax free!"

IS A QUALIFIED CHARITABLE DISTRIBUTION RIGHT FOR YOU?

Making a gift to Geneseo with Qualified Charitable Distributions from your IRA can be an excellent strategy to help Geneseo students and reduce your tax bill.

Please contact us if you think a Qualified Charitable Distribution might be right for you. We would be happy to work with you and your financial advisor to explore this opportunity.